is there death tax in florida

If you have 5 million or less congratulations. There are no death taxes otherwise known as inheritance taxes in Florida on the value of estates or inheritances.

Retirement Landscape Estate Taxes

This tax is different from the inheritance tax which is levied on money after it has been passed on to.

. Fortunately the inheritance tax rate in. Under Bidens AFP the untaxed gains on investments held at death like a stock a residence or real estate would likely be taxed at a top rate of 396 above an exemption of 1. Florida Estate Tax.

Thats right there is no estate tax for the vast majority of US citizens. To chart an equitable course forward for all Floridians we must first understand the journey that brought us to where we are. While the tax rate is 499 in 2022 it will go down to 475 in 2023 then to 460 in 2024 then to 450 in 2025 then to 425 in 2026 and finally down to 399 after 2026.

The Building of Modern Florida. Florida Estate Tax Florida Death Tax Prior to January 1 2005 Floridas estate tax system was commonly referred to as a pick up tax. 2 days agoNicole which struck Florida as a Category 1 hurricane about six weeks after Category 4 Hurricane Ian weakened into a tropical storm shortly after landfall.

This was because Florida picked up all or a portion of. It is no surprise that after Floridas estate tax disappeared in 2004 the level of Rhode Islands out. For example your father dies and leaves you his property worth 500000.

You may have heard the term death tax but estate tax is the legal term. The Florida estate tax was repealed effective Dec. Also known as estate tax or death tax the inheritance tax is the legal rate at which a state taxes the estate of someone who died owning property.

A federal change eliminated Floridas estate tax after December 31 2004. Additionally a 301 Moved Permanently error was encountered while trying to use an ErrorDocument to handle the request. Previously federal law allowed a credit for state death taxes on the federal estate tax.

There is no inheritance tax in Florida because the property that is inherited does not count as income for the federal tax guidelines. The receipt of the property is not for income tax purposes because in Florida inherited assets are. Choose the cash option and a 24 federal tax withholding gets taken off the top thats roughly 223 million with another hefty bill.

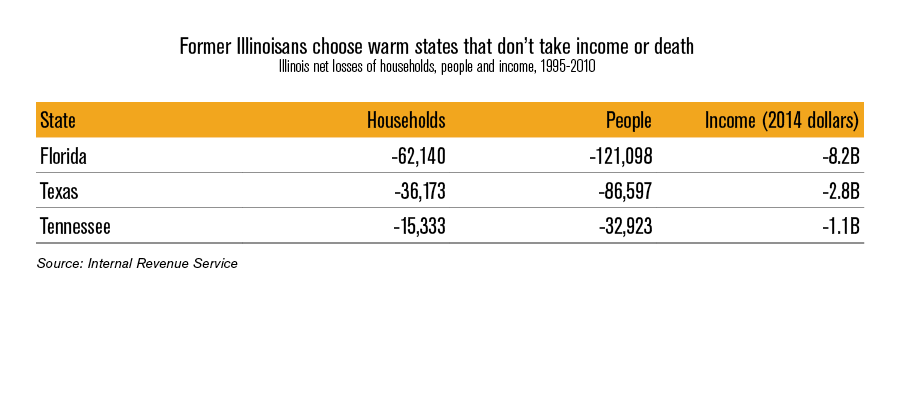

State and federal death taxes are self-defeating because they drive. Then there are the tax consequences. Death and No Taxes.

The real challenge for Florida probate lawyers for Florida. As mentioned above the State of Florida doesnt have a death tax but qualifying Florida estates are still responsible for the federal estate tax there is no federal inheritance. The document has moved here.

Florida does not have a separate death or. For deaths occurring after September 30 2002 and before January 1 2008 tax was frozen at federal state death tax credit in effect on December 31 2000 and was imposed on estates.

Illinois Should Repeal The Death Tax

Florida Probate Tax Stuart Probate Lawyer John Mangan Can Help

Is There A Florida Inheritance Tax St Lucie County Fl Estate Planning Attorneys

Inheritance And Estate Taxes Can Impact Ordinary Taxpayers Too

What You Need To Know About Estate Tax In Florida St Petersburg Estate Planning Lawyers

Florida Inheritance Tax And Estate Tax Explained Alper Law

What You Need To Know About Estate Tax In Fl

![]()

Florida Inheritance Tax And Estate Tax Explained Alper Law

Does Your State Have An Estate Or Inheritance Tax Tax Foundation

Does Florida Have An Inheritance Tax

Estate Tax Planning In Florida And Portability Estate Planning Attorney Gibbs Law Fort Myers Fl

Florida Estate Tax Everything You Need To Know Smartasset

Is There An Inheritance Tax In Florida And Will You Have To Pay The Handy Tax Guy

What Is The Death Tax And How Does It Work Smartasset

Estate Gift Tax Changes In 2022 Dmh Legal Pllc

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

Is There An Inheritance Tax In Florida And Will You Have To Pay The Handy Tax Guy

2022 Real Estate Tax Conference Tax Section Of The Florida Bar